The Month That Was-July 2016

MARKET SUMMARY: Breakout

After over 18 months of sideways action in the markets, July finally saw us break convincingly through the 2,100 barrier in the S&P 500 that had proven to be a powerful resistance level.

After a flat market in June, despite an abysmal Jobs Report and some post-Brexit volatility and drama, all eyes turned towards the July Employment Report. While the June report fueled concerns that all was not well domestically, July’s report showed total nonfarm payroll employment increased by a whopping 287,000 with an unemployment rate of 4.9%, relieving anxieties from the prior month. This report drove us close to new highs early in the month.

Mostly better than expected earnings reports propelled us to all-time high levels in slow, almost auto pilot-type trading in the second half of the month. We have found that when things are calm, markets need to find something to worry about to start moving lower. While not everything has been positive, thus far there has not truly been that one issue upon which worries have coalesced. Potential concerns are always present, and we enter August with yields on the Ten Year Treasury settling just under 1.5% as global yields remain at historically low levels. Oil prices have dropped precipitously over the past month, yet this has not seemed to have affected or influenced the overall market up to this point.

Last month, we discussed how cash levels were historically high and that through basic principles of supply and demand, both bond and equity prices could be given a boost if cash levels declined. Given the slow trading and low summer volumes, we find it hard to imagine that substantial amounts of sideline cash have been employed, which leaves this potential impetus for higher prices still in place.

CLOSED-END FUND (CEF) COMMENTARY: Are Equity Funds Ready to Narrow?

Over the past two years we have spent a great deal of time discussing the concept of generic widenings in CEFs. In so doing, we have typically focused on bond funds. This is due to the fact that bond funds have had multiple periods of dramatic widenings. Most notably, bond funds widened close to 10 discount points beginning in May of 2013 (taper tantrum) and roughly 5 points in the middle of 2015. Accordingly, bond funds were the most illustrative group when it comes to generic widenings and the effect they have on investment returns.

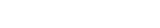

As we have discussed in previous commentaries, beginning in mid-February of this year bond

funds began the narrowing recovery we have been anticipating. In July, this narrowing

continued, as bonds added more than a point in the month. For the year, this brings the recovery

in the average of bond discounts up close to 5 discount points. While the narrowing has been

somewhat disparate in terms of which individual sectors have fully recovered (more on this in

next month’s commentary), overall the upward trajectory in bond discounts was maintained in

July.

But what about Equities? When it comes to equity funds, the widenings that have occurred were

not as dramatic but were present nonetheless. In 2013, equity funds widened by about 3 discount

points on average. Similarly, in 2015, the average discount of equity funds declined another 3

points. While the magnitude of the widenings were smaller than that experienced in bond funds,

equity funds did enter 2016 at rather depressed levels.

As shown in both the chart and graph below, unlike bond funds, equity funds did not narrow all

that much in the first half of the year. In fact, coming into July, equities had only narrowed by

about one half of a discount point. By the middle of the month, they had actually given up even

that modest gain and were near the same discount level seen at the beginning of the year.

However, in the final two weeks of July, equity funds made a strong move upward of almost a

full discount point. This brought equity funds back to a level they had not traded at since July of

2015. That being said, these levels are still historically depressed and equity funds still trade at a

level from which generic narrowing can still be the expectation. Whether equity funds can

maintain their recent narrowing trajectory, is, in our minds, the most interesting question facing

CEFs for August.