The Month That Was - April 2016

MARKET SUMMARY: Markets Hold Gains, Trade Range-Bound

After spending the majority of 2016 in negative territory, markets began the second quarter slightly above 2015 closing levels. Despite the massive run-up from mid-February lows, bears have found it difficult to gain any traction in the second quarter. In what may perhaps be the most notable event in April, the price of oil rose dramatically to over $40 a barrel. If prices can hold this level, they may very well create the sense of “stabilization” that we have been discussing as of late.

While we witnessed some up-and-down moves early in the month, the net result was a market that traded sideways and within a tight range on the S&P of 2040-2100. The second half of April saw the market grind higher ever so slowly. Underneath the surface, there appears to have been a basic rotation occurring, as investors piled into bank (+7.5%) and oil (+20%) while exiting technology (-5.5%). In the end, April was a positive month, as markets not only held their recent gains, but also spent much more time near the top of the range than the bottom.

As we move into May, we believe that the standing presumption is that the markets will continue to trade range-bound until there is an impetus to break out. Currently, we see a market that is climbing slowly higher. Factors that could help the market would be the continued strength of financials as well as a bit of a bounce back from the technology sector. Also, as we have been stating for quite some time, the continued stabilization of both oil prices and the value of the U.S. dollar would create a solid base for economic growth.

CLOSED-END FUND (CEF) COMMENTARY: Solid Month for Bond Funds, Signs of the End of TINA?

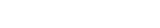

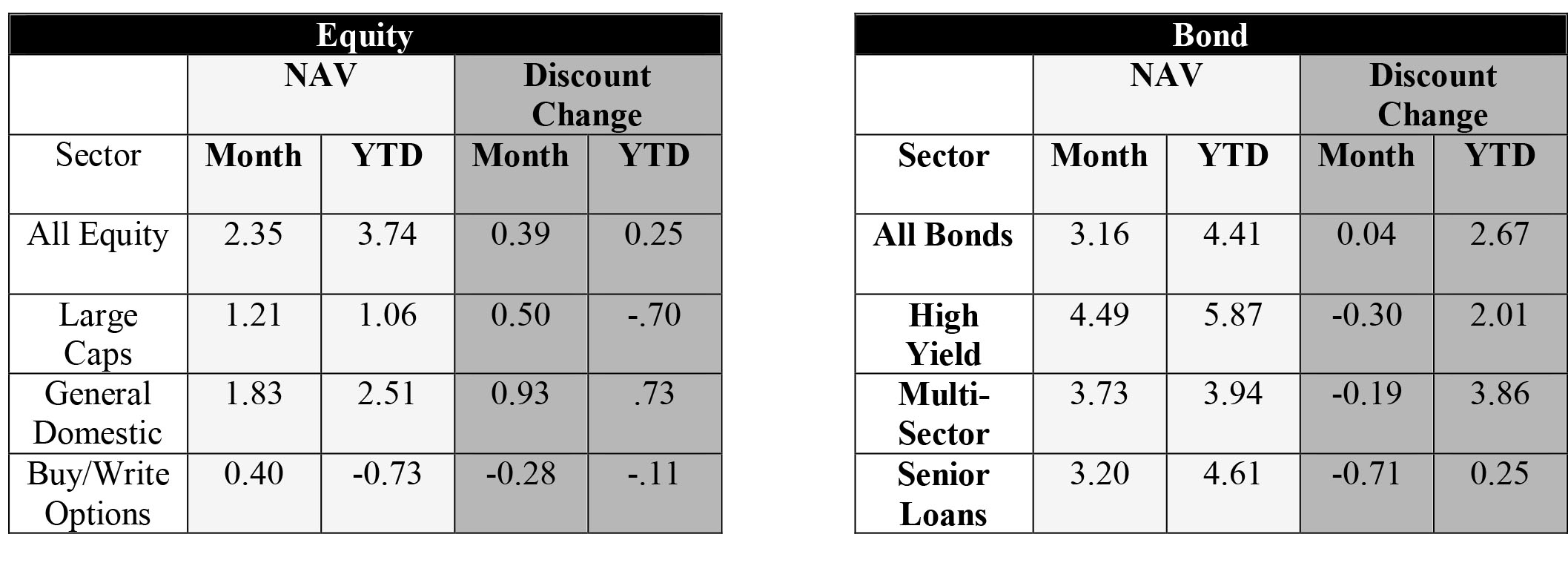

April was a positive month for CEFs across the board. Equity CEFs provided higherthan-market net asset value (NAV) growth for the most part, while bond/fixed income funds provided significant NAV growth. As seen in the chart below, overall discounts remained stable.

We believe that the most interesting and encouraging aspect of the month was the broad strength in NAVs across bond funds. As we have been writing for the last three years, there has seemed to be a general disdain for bond and fixed income investing. While we have long believed this to be an irrational (and to date completely misplaced) fear of a “rising rate” environment, it has nevertheless been the case that the TINA mentality has prevailed. Under the TINA (“There Is No Alternative” to equity allocations) rationale, any selling of equities has resulted in investors holding cash instead of the historically normal allocation to fixed income and bond funds. The result of this has been declines in bonds on downturns without any corresponding bounce back on recoveries.

In April, we began to see signs of the possible demise of TINA. Although the equities markets traded up and down within a range, bond funds rose in the general and steady way we typically expect them to. Most significantly, during the final week of the month, a week in which the equity markets corrected slightly, bond funds did not follow. Instead, bonds added to gains from earlier in the month. While this would not be a particularly interesting phenomena in a historical context (what Dan G. would simply call “bonds doing their job”), this is an outcome we have not witnessed often enough as of late. While this short period of time does not fully support the premise that TINA has ended, it is a positive turn of events that we will monitor closely in the coming months.