The Month That Was-May 2017

MARKET SUMMARY: Stay in May

In last month’s commentary, we discussed how April was a quiet month on the Political Front, which allowed markets to focus on Fundamentals such as earnings and economic conditions. All was quiet in Washington early in May until a story broke about our President’s possible inappropriate involvement with Russia, leading many investors to speculate that imminent impeachment was a possibility. Markets reacted with an almost 2% drop in the middle of the month. However, the downdraft was short-lived and markets recovered and closed up 1% for the month.

We feel that something veteran Market Strategist and market observer Byron Wien pointed out in a CNBC interview a couple weeks ago helps explain the current dynamics quite well. He ranked, in order of importance to markets, the following items:

1. Earnings

2. Interest rates

3. Economy

4. Washington

If we walk through these factors, we see a pretty solid basis for the continued upward creep of the markets. As we had discussed in April, corporate earnings have been solid as of late, with a general rise in earnings this season of more than 10%. On the interest rate front, rates have remained stable and traded around lower levels of their recent range. This stability was welcomed by markets.

As for the economy, there remains a basis for the consensus view of continued modest growth. As those who receive our daily emails are by now accustomed to hearing, US economic data released this month consistently fell into the “a bit less than expected but solidly expansionary” category. Global data has been even stronger. Accordingly, the economy continues on a solid, if unspectacular, growth trajectory with European economies leading the way.

Finally, drama in Washington may lead many observers to infer that a weakened Presidency will reduce the probability of passing the pro-growth agenda set forth. However, to the extent that this has already been recognized as a possibility and thus discounted by the markets, that is not necessarily a negative. We believe that markets cannot price in any imminent "pro-growth" agenda policies as it is becoming increasingly clear that nothing is actually imminent. While markets generally hate uncertainty, this is a different type of uncertainty: one with a cautious optimism about a positive outcome and a worst case scenario of status quo.

CLOSED-END FUND (CEF) COMMENTARY: Are Discounts Topping Out? It Depends…

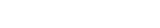

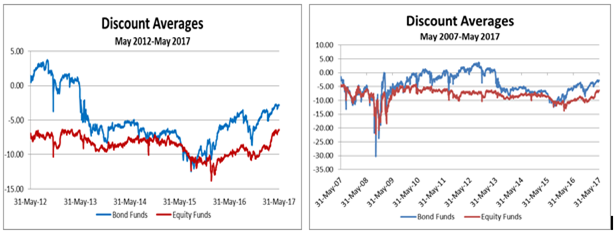

This month, as shown in the table above, CEFs continued their general narrowing pattern, if only modestly. For the calendar year 2017, we have seen a steady generic narrowing across the board, with equity funds narrowing almost four (4) discount points and the average bond fund narrowing a bit more than two (2) points. While this has been most welcomed, it has led many CEF observers to ask the question: Have discounts gotten to the point where they may have topped out?

As with all questions in the economic and investment arena, the short answer is “It Depends.” More specifically on this issue, it depends upon the timeframe used to gauge historic averages of CEFs.

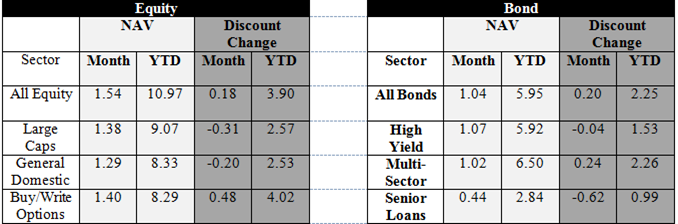

If one looks simply at the near term, discounts do look a little high. As shown in the 1 year and 3 year graph above, recent narrowing trends have left CEF discounts at higher levels. In fact, taking this short term view, CEFs could be seen as potentially overvalued.

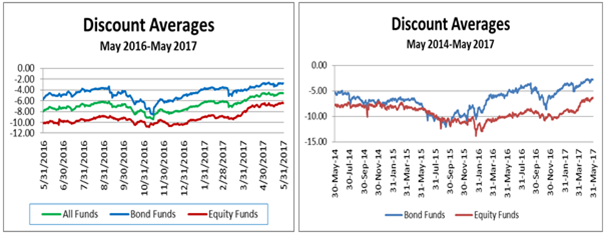

However, if one takes a longer term view, things appear to be much different. In this regard, it is important to point out that over the past decade, CEFs have had two significant pricing dislocations which have led to periods of generic widenings. In 2013, CEFS had a large widening period relating to the “taper tantrum.” Also, in 2008, CEFs suffered through a very large widening period, as investors lost confidence in almost all investments.

As shown in the five and ten year charts, a view of longer term discount averages paints a different picture from a short term look back. Due to the dislocations discussed above, CEF discounts had been trading at historically depressed levels. Accordingly, the recent narrowing strength in CEFs can be seen as only a partial recovery. In this regard, for CEFs to fully recover from the dislocations, even further generic narrowings would need to occur.

So where do we go from here? At SFS, we believe that the answer to the fundamental question of relative levels of discounts is somewhere in between the two analyses discussed above. On a purely longer term historical analysis, it appears that CEFs, especially bond funds, have continued upside potential. However, there have been additional fundamental changes to the CEF marketplace which could affect discount levels overall. On the positive side, increased demand (higher levels of overall investment) coupled with decreased supply (less CEFs due to mergers and open-endings) would support higher levels. However, on the negative side, the increased presence and popularity of exchange traded funds (ETFs) as an alternative could lead to decreased demand and support lower overall levels.

At SFS, we primarily favor a reactive approach to discount movements. That is to say, we prefer to monitor movements in discounts and adapt our trading strategies in lieu of committing to strategies in advance based upon predictions of CEF discount movements. But that being said, we currently see no reason to believe that CEFs have any distinctly expected directionality. Under such circumstances, especially when coupled with the current lack of volatility in the markets in general, a plateauing of discounts certainly appears to be a rational expectation for the near to mid-term.