The Month That Was - May 2016

MARKET SUMMARY: Sell in May and Go Away?

There is a well-known trading adage that warns investors to sell their stock holdings in May to avoid a seasonal decline in equity markets. An investor who uses the "sell in May and go away" strategy sells his or her holdings in May and reenters the market in November. The theory claims that by doing so, the investor avoids the traditionally erratic months between May and November and ends up with better performance than someone who buys and holds throughout the year.

After the steep run-up since February, it seemed logical, if not obvious, that the market needed a rest. Cute adages like the one above sound wonderful and appeal to many market participants. When it works, they feel smart and can point out how obvious it was after the fact. However, markets are rarely so accommodating.

May 2016 provided a little something for both bulls and bears. Early in the month, we had a solid retail sales report, only to be followed shortly thereafter by individual retail companies, especially department stores, reporting weak quarters. Then Walmart posted a strong report (confused yet?). We also received solid reports on the economy, which should ultimately translate into stronger GDP growth. However, this strength would then prompt the Federal Reserve to raise rates faster than market participants expect and desire. There appears to be more certainty regarding the Presidential Candidates that will square off in November, but uncertainty remains about what a Trump presidency would mean for stocks.

It was a rather quiet trading environment throughout the month as investors were ultimately ambivalent about the direction of the markets. In the end, markets drifted higher and closed at the top end of their recent range, only a couple percentage points away from all-time highs.

For June, we have ECB and OPEC meetings on Thursday, an upcoming vote on Brexit, as well as a Federal Reserve Meeting later in the month. What could the catalyst be to send us to new highs? Perhaps simply a lack of drama stemming from these events could propel us higher.

CLOSED-END FUND (CEF) COMMENTARY: Is This Time Different?

It was this month three years ago when Bernanke stated that he intended to start the process of ending the program of quantitative easing. This led to the infamous “taper tantrum”, which wreaked havoc on bond markets and created a nightmare scenario for CEF investors. First, bond markets violently priced in the potential effect of a rising rate environment. Second, investors fled from CEFs in a Chicken Little style manner, causing additional losses across the board in CEFs due to generic widening.

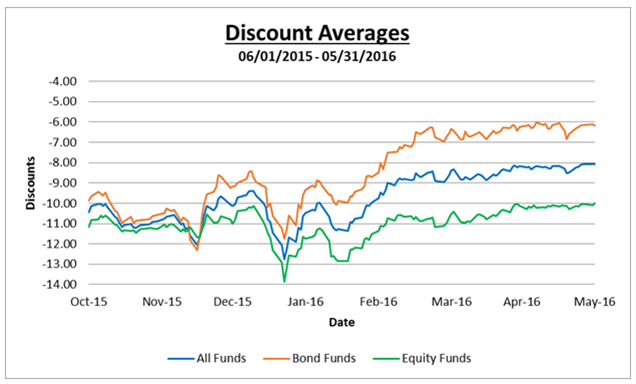

Last year, when Chairman Yellen announced her commitment to raise rates upward from the “emergency” zero levels, a similar scenario occurred. First, bond markets once again priced in the possible effects of rising rates (we actually believe this is at least the third time the market has priced in this scenario). Second, bonds once again sold off, pushing the average discount of bond CEFs to somewhat historically wide levels.

So it was not without a little angst that we read the Federal Reserve minutes on the 18th of this month, which stated that the Fed was still very committed to raising rates. They indicated that they believed the June or July meeting was an appropriate timeframe, as long as the economic and employment data continued at the modest levels we have seen over the past few years. On the day following the release of the notes, bond funds opened up down a percent or so across the board. However, since that date, our bond funds traded positively on a daily basis for the remaining seven (7) trading days of the month.

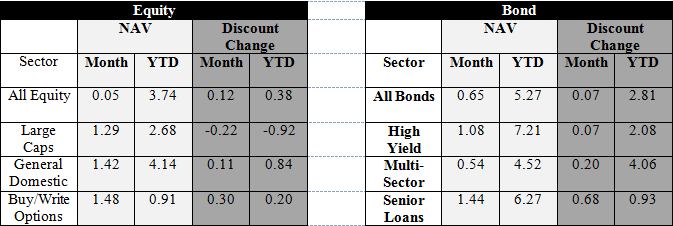

So is this time different? While it is still far too early to make this determination, the initial signs have been encouraging. Since 2013, we have often discussed what we have believed to be irrational movements in CEFs based upon Fed commentary. As a prime example, we have discussed that in past dislocations, both high-yield and senior loan funds have been heavily sold off, even though we believe that these are two sectors that should perform relatively well in a raising rate environment. We have often referred to these sectors as the babies that have in the past been thrown out with the bath water. Accordingly, we are encouraged that since the date of the release of the notes, not only has the overall discount level remained stable, but senior loans have actually narrowed by more than a percent.

Events in June should tell us a great deal. Bond market and CEF reactions to the Jobs report this Friday, as well as the possible rate rise at the June meeting (or potential hawkish commentary if the Fed decides to wait until July), will provide us with a clearer picture of our expectations of bond funds moving forward.