The Month That Was - October 2015

MARKET SUMMARY: Market Negativity Wanes, But Sentiment Remains Fragile

We entered October with both domestic and global markets wobbly, sentiment extremely low, and an abundance of caution by market participants. One month later, (a mere 22 trading days), there is a sense of “what were we so worried about again?” There is a famous quote from Warren Buffett which says, “Be fearful when others are greedy and greedy when others are fearful.” That certainly was the case in October as markets recouped losses for the year in spectacular fashion. Perhaps it wasn’t good news that propelled the markets higher, but the absence of all the bad things that were supposed to occur imminently. As clouds lifted and the worst case scenario didn’t materialize, markets rose steadily throughout the month.

Moving into the final two months of 2015, we believe that market sentiment remains fragile. Therefore, we think that there remains the potential for market volatility, as typically small factors can still trigger outsized movements in the markets. While there are a myriad of data points upon which one could focus, we suggest that the stabilization and recovery of the price of oil may be the most important. Not only would this stabilization remove a great deal of the fear that commenced the correction in the third quarter, but it would also lead to increased pricings throughout the credit markets, specifically in higher yielding bonds. Additionally, a rise in oil prices would help create the inflationary pressures that the Federal Reserve is looking for in order to begin the process of restoring non-emergency levels of interest rates. In the absence of any sentiment swings, we would expect modest gains into the end of the year reflecting the modest growth of the US and global economies as a whole.

CLOSED-END FUND (CEF) COMMENTARY: CEFs Show Signs of Recovery

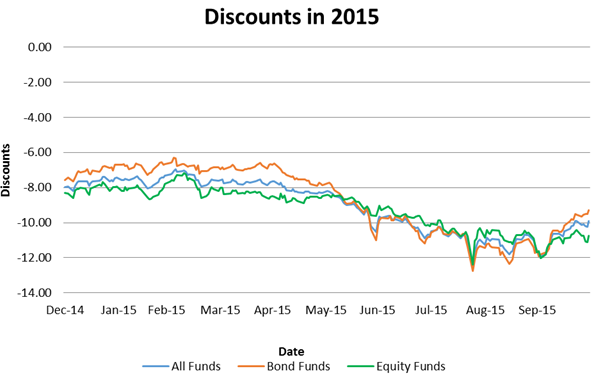

As we entered the month of October, Closed End funds (CEFs), having suffered through a five month period of significant declines, were at historically wide levels. Further adding to the declines, CEF net asset values (NAVS) had performed poorly year to date. However, in October CEF discounts showed signs of bottoming out and recovering.

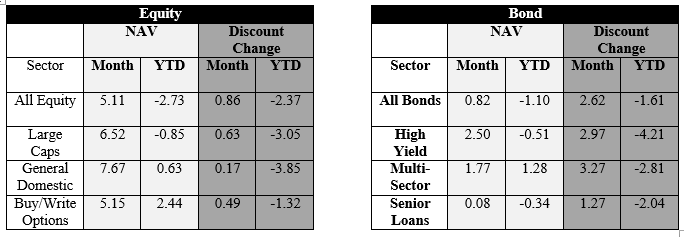

In regards to bond CEFs, bond fund NAVs had a strong month. As shown in the chart below, bond funds posted some significant gains in the month of October. However, as also shown below, this led to only flattish NAV returns year to date in many sectors. In an environment in which rates have held pretty stable throughout the year (despite some periods of volatility) coupled with a growing, albeit modest, economy, we believe that the lack of returns year to date reflects the continued dislocation of bond pricings, which has priced in the “inevitable rise in rates”. Accordingly, we believe that there remain additional returns to be had as bond markets resolve this dislocation. With respect to discounts, bond funds had an extremely strong month, as it appears that the buyers’ strike in these sectors has subsided. Though bond funds narrowed on average 2% in October, providing a nice tailwind for CEFS, they still remain well below their historical average.

As for equity CEFS, funds NAVs posted solid NAV gains in October. For the most part, NAVs lagged overall markets, but we believe this is typical in a period of rapid growth in the markets, especially in funds that utilize buy/write protection strategies. Equity CEF discounts also recovered somewhat, but not as much as their bond counterparts, experiencing a “tailwind” of approximately 1%.

Overall, October was certainly a strong month for CEFs both in terms of discounts and NAVs. While this was certainly a welcome sign to CEF investors, there is certainly much more to be regained moving forward in the short- to mid-term. At SFS, we believe that the timing of additional recovery is most likely determined by two potential catalysts: 1) tax-loss selling and 2) a Federal Reserve rate rise, each discussed below.

With respect to tax-loss selling, it is typical that CEFs witness a generic widening as sellers out number buyers due to advisors taking advantage of held losses for tax efficiency matters. However, each year is different depending upon the amount of selling that needs to be accomplished. This year will be particularly interesting, due to the dramatic correction the overall markets experienced in August. Questions concerning the extent of losses that were realized during the correction and what amount of turnover has already occurred make this year’s tax loss selling more unpredictable. One could even make a compelling argument that there will be no noticeable effect this year. While we would expect the effects to be smaller than normal, as advisors such as ourselves have already accomplished some of the required selling, we will be monitoring the potential effects especially as we get to the end of November, the traditional starting point for tax loss selling widenings.

We believe the most interesting, and potentially most substantial, catalyst moving forward for CEFs will be the initial rate rise by the Federal Reserve, commonly referred to as “lift off”. While it is somewhat axiomatic that if rates rise, bond prices will fall on a mark to market basis, at SFS we have a bit of a contrarian view. We maintain our belief that over the past two years, the fixed income and bond markets have prepared for “lift off” and accordingly, have already priced in a rise in rates. In fact, because the Federal Reserve continues to act in a more dovish manner than originally expected, we believe that a slower and smoother rise in rates will have a modestly negative or even positive effect on bond pricings. Further, we believe that there are many investors who have waited to properly diversify their portfolios in anticipation of “lift off”. Therefore, we think that an initial rate rise will create additional buy side pressures, helping discounts to narrow across the board. Additionally, “lift off” will also release some of the pressures stemming from the dislocation of bond pricings, which will translate into better than expected NAV returns across sectors.